Foreign direct investment increased by 3% in 2023. Seaports as beneficiaries

By Marek Grzybowski

By Marek Grzybowski

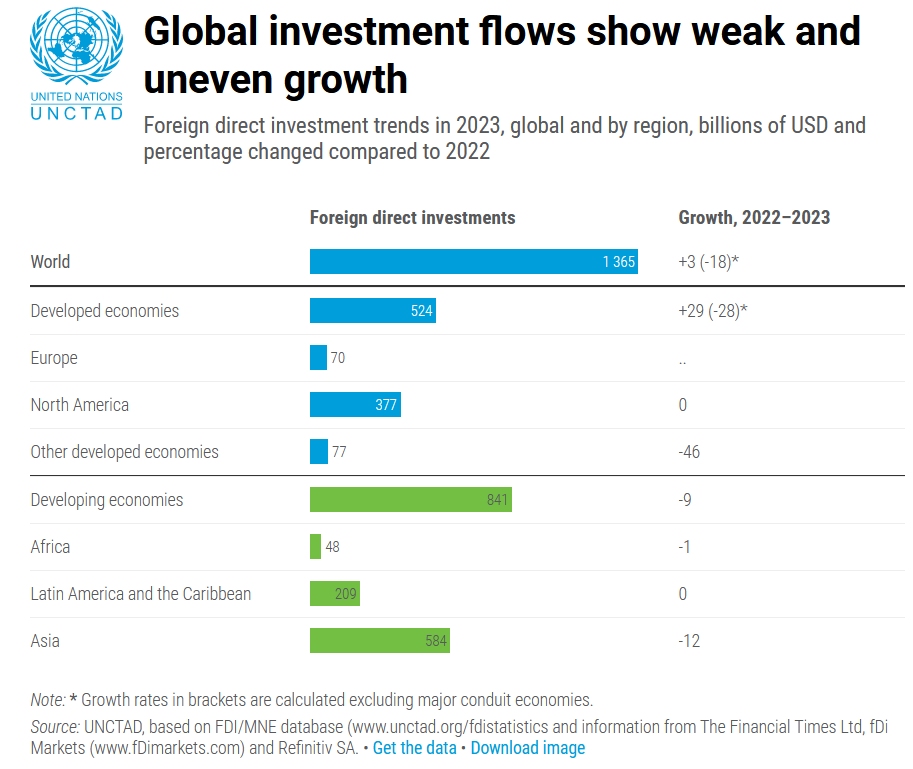

Global foreign direct investment increased by 3% in 2023, which according to UNCTAD is the result of lower fears of recession. In the maritime business, investors were active especially in the Oil & Gas sector and seafood production, tourism, maritime transport and ports. The offshore wind energy sector, however, experienced unexpected withdrawals from contracts, as we wrote about in GospodarkaMorska.pl. Global foreign direct investment trends have exceeded previous forecasts published in early 2024, UNCTAD analysis reports. The growth was driven by several leading European economies. Global foreign direct investment (FDI) exceeded last year’s forecasts for 2023. Estimates show that the dynamics reached 3%. Globally, this gave an estimate of USD 1.37 trillion, according to the Global Investment Trends Monitor, published by UNCTAD on January 17 this year. A key factor was several European economies that “often act as intermediaries for FDI intended for other countries,” the report emphasizes. – Surprisingly, after excluding these intermediary economies, global FDI flows show a sharp decline of 18% in 2023. The rest of the European Union saw a sharp decline of 23%, and the United States, the world’s leading recipient of FDI, saw a decline of 3% – they calculate UNCTAD experts. UNCTAD analysts point out a disturbing decline in the number of inquiries regarding international investment projects last year. This is especially true for merger and acquisition financing, which dropped by 21% and 16%, respectively. During this time, greenfield project announcements declined by 6% in volume but increased by 6% in value. “A moderate increase in FDI flows seems possible in 2024.” the report said. This optimism is based on the forecasted stabilization of inflation close to the core and reduced borrowing costs in the main markets. Significant threats remain, including geopolitical tensions, the report states. The growing debt of many countries is also worrying. Concerns about further “fragmentation of the global economy” are not decreasing.

The Asian and African FDI engine is slowing down UNCTAD notes that overall FDI activity in developing countries in 2023 showed a 9% decline. Investments in these countries reached USD 841 billion. The greatest decline in investment was recorded by developing Asian countries. These countries recorded a decline of 12%. China experienced a 6% decline in FDI inflows but showed an 8% increase in new greenfield project announcements. India, another regional giant, saw a 47% decline in FDI inflows. However, this country remained in the top five global destinations for greenfield projects. ASEAN (Association of Southeast Asian), the previously traditional direction of dynamically growing investments, has clearly slowed down. There was a 16% decline in FDI in the region. However, the region remained attractive for manufacturing investment, with a remarkable 37% increase in investor inquiries for greenfield projects. FDI is expected to grow in countries such as Vietnam, Thailand, Indonesia, Malaysia, the Philippines and Cambodia. On the other hand, FDI inflows decreased by only 1% in Africa. They remained stable in Latin America and the Caribbean. This was due in part to an influx of investment funds into Central America and a 21% increase in FDI in Mexico, the region’s second-largest economy.

More: Foreign direct investment increased by 3% in 2023. Seaports as beneficiaries https://www.bssc.pl/2024/01/26/foreign-direct-investment-increased-by-3…