A robust cluster model and an EU-focused open platform cluster

Summary: The Piedmont region is classified as a 'moderate innovator+' among European Union (EU) regions. Nevertheless, the region's performance has improved significantly in recent years and it is now in the top 20% of OECD regional economies. Following an intensive regional development study, the previous S3 strategy was revised and the new version takes a cross-sectoral approach with three transversal innovation components (CTI) representing the direction of innovation: Digital Transition, Green Transition and Socio-territorial Impact as well as Six Priority Innovation Systems. A particular feature is the embedded cluster model, which gives each cluster in the region a remit tailored to its strengths. As the region has long been based on traditional industry, with many small businesses, it has historically been prone to crises. Clusters such as Torino Social Impact are needed for the social economy, which has tended to be addressed at national and European level. The Torino Social Impact Cluster is therefore the ideal vehicle to raise awareness of the issue, as it is an open platform with more than 260 actors and is anchored in many European projects. As the City of Turin is a partner and co-initiator of the cluster, Turin society benefits from the results achieved within the framework of the cluster. This case study of the Piedmont region and the Torino Social Impact cluster illustrates how the regional representation and the cluster organisation in Turin are strengthening the innovative capacity of the Piedmont region with different approaches.

The Piedmont Region

The region Piedmont covers an area of approximately 25,400 square kilometres, stretching from the Swiss Alps and the Italian region Aosta Valley in the north, through Lombardy and Emilia-Romagna in the east, to the Italian Mediterranean region Liguria in the south and France in the west. It is the second largest Italian region in terms of area after Sicily. It has a population of over 4,300,000, spread over a total of eight provinces. In terms of total regional economic size, the region is rich in highly specialised facilities, with more than 426,000 active firms, four regional universities, national research and TT institutions such as IRIM (Metrology Institute) and IIT (Italian Institute of Technology), science and technology parks, start-up incubators, accelerators and bank foundations.

With a regional GDP of approximately €140 billion, the region is in the top 20% of the OECD regional economies and is comparable to regions such as Berlin (Germany) or Warsaw (Poland). However, the region shows weaknesses. On the one hand, the region has suffered badly from past crises (the 2007-2009 and 2011-2014 recessions) and has not recovered as well as others. The region's resilience thus seems to be comparatively lower compared to others. In addition, the region fell into another recession in 2019, which mainly affected the very strongly represented traditional industry and caused production figures and thus the economic strength of the region to decline. On the other hand, Piedmont shows geographic imbalances regarding the administrative provinces.

Turin, the capital and main metropolitan area of the region, is a major European crossroad for industry, commerce and trade. The city has traditionally been one of the leading cities in the production of cars, which is still the main industrial asset of the territory and the region. The Functional Urban Area (FUA) of Turin covers less than 7% of the region’s geographic territory, but hosts 40% of the total regional population and 44% of its workers in business sectors and contributes 55% of the regional GDP, while the remaining 45% is distributed across the other seven provinces. With a GDP of $84 billion, the city is the world's 90th richest with regard to the purchasing power parity[1] and is ranked third in Italy, after Milan and Rome, for economic strength.

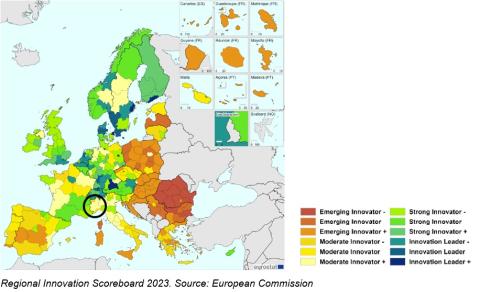

According to the EU Regional Innovation Scoreboard, the NUTS 2 region of Piedmont (ITC1) is classified as a "moderate innovator+" among the regions of the European Union (EU), which is rather weak compared to the above-mentioned peer regions. Nevertheless, the region's performance has improved significantly in recent years (+19.7% between 2016 and 2023), especially in the face of the above mentioned recession and the recent COVID-19 crisis slumps.

[1] http://www.citymayors.com/statistics/richest-cities-2020.html

INDUSTRIAL ECOSYSTEMS

Piedmont is home to traditional manufacturing industries such as textiles, goldsmithing, agri-food, agro-industry and, especially in Turin, car production. Other more recent specialisations include aerospace, rubber and plastics production, green chemistry and advanced services in ICT and life sciences. Based on these industrial specialisations, the regional industrial and innovation policy has applied a “specialisation rationale” over the last 15 years: the region initially identified 12 technological domains (2007-2013 programming period), which have been regrouped into seven functional domains for the 2014-2020 programming period, according to the new S3 paradigm.

Before the current version of the S3 strategy was adopted, the OECD conducted a regional development study in the Piedmont region in 2021. The aim of the study was to deepen the understanding of how the Piedmont region can best use innovation policy as a lever to drive its industrial transformation, increase productivity and boost competitiveness. For the 2014-2020 programming period, Piedmont has adopted an S3 strategy based on:

- two innovation priorities: ::

- Innovation in the industrial production system, divided into six areas of technological innovation or specialisation; and

- Innovation for health, demographic change and well-being.

and

- two “transversal” strategic development paths, defined as “Smart Trajectory” and “Resource efficiency Trajectory” respectively.

The recent revision of the S3 strategy (2021-2027) was significantly inspired by the lessons learnt from the previous period, socio-economic trends, a strong dialogue with stakeholders in the region and especially the findings and recommendations of the 2021 OECD study and led to a revision of the innovation areas with a more inclusive approach to innovation. This resulted in the following structure for the Smart Specialisation Strategy 2021-2027:

- Three Transversal Innovation Components (CTIs), representing the direction of innovation: Digital and green transition, socio-territorial impacts and the topic of raising capacity/skills for innovation

- Six Priority Systems of Innovation (SPI), which constitute the evolution of the previous priority areas of specialisation.

hile the 2014-2020 specialisation areas had a strong vertical character and an exclusive technological focus, the priority system adopts a more integrated and 'systemic' vision. The key aspect is the focus on the benefits generated, rather than on the specific good/product in which the sector is specialised. For example: "mobility" rather than "automotive" or "health" rather than "pharmaceutical or biomedical". The Six Priority Systems of Innovation (SPIs) are:

- Aerospace

- Mobility

- Advanced manufacturing

- Green technologies, resources, materials

- Food

- Health

In addition, the S3 provides specific orientation/guidance for the implementation policy, thus improving the policy mix:

- supporting MSMEs in strengthening their dimension and innovation capacity

- promoting collaboration/networking/value chain approach among enterprises and stronger partnerships with research

- continuing to focus on product innovation, but also promoting non-technological innovation

- building innovation capacity of SMEs by supporting reskilling/upgrading measures and/or new skilled human resources

- encouraging economic and industrial diversification and accelerating the transfer of R&D to the market (including through increased support for start-ups)

- strengthening the regional innovation system by improving the coordination of regional innovation actors and strengthening the role of regional innovation cluster organisations

Further reading:

- OECD Regional Development Study: Regional Innovation in Piedmont, Italy: https://www.oecd-ilibrary.org/urban-rural-and-regional-development/regional-innovation-in-piedmont-italy_7df50d82-en

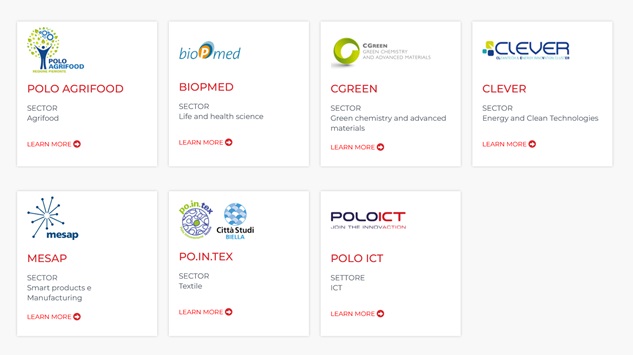

CLUSTER POLICY AND CLUSTERS

Piedmont's policy is directly aimed at improving the performance of clusters. In 2009, Piedmont became the first region in Italy to implement a policy to finance the creation and development of cluster management organisations. The performance of clusters has thus been stimulated by regional policy, without which the cluster system would probably not have developed in its current form. With the support of the region, clusters have gained recognition as qualified actors in the regional ecosystem, not only enhancing their sectoral competences, but also going beyond them. With reference to the Sistema Poli Piemonte, each of the region’s seven clusters maintains its vertical competences but shares its transversal competences with other clusters.

- The Clever Cluster is the project leader, responsible for project management and monitoring, communication and animation activities, and the coordinator of the ecological transition area.

- The Agrifood Cluster coordinates the system actively linked to the involvement of the business system in R&D,

- BioPmed coordinates the wellness and community area and the system activities related to extra-regional networks,

- ICT is the coordinator of the digital transition area,

- Cgreen is responsible for the area of skills and promoting a better match between training supply and demand, and

- MESAP is responsible for activities related to the exploitation of regional research and innovation results, also known as territorial innovation marketing.

The seven clusters participate autonomously in various national and European projects and have enabled more than 1,200 projects and registered more than 3,000 partners since their foundation. Today, the clusters have more than 1,200 members, 70% of which are SMEs, and indirectly activate more than 10,000 companies in the area, which participate in formal or informal networks related to their competences.

Recognising the national and international position of the clusters, it is envisaged that they will be entrusted with the task of assisting the region in monitoring initiatives, networks and platforms at national and international level. This is considered strategically valuable for the strengthening of the regional innovation system and for the implementation of the S3 in general. They are expected to create a new working model to increase the impact of regional R&D&I policies for the benefit of the territory. In addition, the clusters' role is to support dialogue between all stakeholders in the region and to promote technology transfer for an increasingly smart region, as well as to work with key players to promote the growth of the local manufacturing base. Thus, in the new model of action of the regional innovation clusters, they act as system integrators to strengthen the transversal dimension rather than specific sectors. In the cluster system of the S3 2021-2027 framework, they continue to act as system integrators, maintaining their vertical competences in their respective domains.

Further reading:

STRATEGIC CHALLENGES

The main challenges for the Piedmont region are related to the broader challenge of industrial change (digital and green), which is a long and complex process for a region like Piedmont, where traditional and manufacturing industries have been highly important in the recent past.

The predominance of small firms compared with medium and large ones, and the lower diversity of production specialisation compared with similar regions, make the Piedmont regional economy more vulnerable to systemic shocks or sectoral crises. This lower resilience is also reflected in greater structural fragility and the difficulty of small firms to innovate and scale up. In addition, even if a proper cluster policy is in place, there is a low level of cooperation/networking between firms and public research. More generally, there is a high percentage of SMEs not participating in innovation programmes, with weak internal innovation capacity, weak management skills and limited involvement in the innovation system. The region is already addressing these challenges with the recent revision of the S3 strategy. The aim is to diversify productive assets, also by strengthening certain sectors with growing demand, particularly in knowledge-intensive services. Another pillar of the regional R&D policy is the promotion of collaborative research, technology transfer and access to research infrastructures and services for SMEs. The challenge is to be more inclusive and help these companies by reducing/removing barriers to innovation policies.

On a broader scale, Piedmont is heavily affected by demographic change, which is a pervasive challenge for the economy and society and acts as an incentive to find solutions capable of retaining or attracting new residents to the area.

THE “PROXIMITY AND SOCIAL ECONOMY” ECOSYSTEM

In Piedmont, there are about 40,000 organisations dedicated to the social economy. Of these, about 4,000 are for-profit enterprises pursuing social objectives. In addition, Piedmont already has a well-developed network of institutions that support social entrepreneurs. Torino Social Impact, for example, acts as a cluster management organisation promoting high-tech social entrepreneurship in the Turin area. However, the implementation, recognition and financial support of this industrial ecosystem – which is relatively new compared to other industries – is still in its infancy. In 2021, Italy adopted the Second National Action Plan on Business and Human Rights, which sets out common guiding principles at national, foundational and operational levels.

In general, it is challenging to find a specific policy or “market” for social economy and proximity, as in every industry or technology area there is a part that deals with aspects of the social ecosystem aspects. Italy, in allocating the resources of the National Social Policy Fund (FNPS), has approved the National Social Plan 2021-2023, which aims to define the frame of a structural process for the system of social services, which is currently still fragmented and unable to offer the certainty of taking care of those who find themselves in conditions of need, and to better promote social cohesion and “resilience”, which have emerged as essential elements in recent years.

A similar situation occurs at the regional level, where regional plans tend to focus more on the social aspect of the social economy, but (still) pay less attention to the economic and strategic part. On the other hand, the picture looks different at European level. The European Union mobilised €2.5 billion to support the social economy between 2014 and 2020. In December 2021, the European Commission adopted the new EU Social Economy Action Plan, which commits to supporting social investors through increased EU repayable and non-repayable finance for the years to come. Clusters like Torino Social Impact, which are specialising in these industrial ecosystems, are therefore more likely to attract attention at EU level than at national or regional level.

TORINO SOCIAL IMPACT

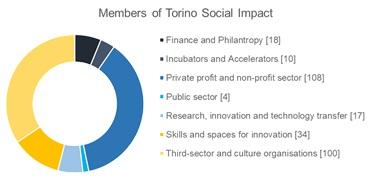

Torino Social Impact is a cluster organisation based in Turin, Italy, dedicated to driving positive social change through collaboration and innovation. The organisation brings together a diverse network of stakeholders, including SMEs, non-profit organisations, government agencies and academia, all united by the common goal of addressing societal challenges.

The organisation's roots can be traced back to the early 2000s, when there was a growing recognition of the need to address complex societal challenges through a multi-sectoral approach. In November 2017, a Memorandum of Understanding was signed by several stakeholders, such as the Municipality of Turin, which established the cluster organisation with the mission to promote social innovation, sustainability and social entrepreneurship in the Turin region. It was seen as a response to the growing need for more effective and collaborative solutions to pressing social challenges. The Chamber of Commerce of Turin and the Compagnia di San Paolo finance the cluster as part of the activities of the Social Entrepreneurship Committee.

Over the years, the open platform of Torino Social Impact has continued to grow and has attracted a wide range of up to now over 290 members, including companies committed to corporate social responsibility, start-ups with a social mission, non-profit organisations and academic institutions specialising in social research.

This growth has enabled Torino Social Impact, or rather its members, to expand its reach at national and European level and to implement several projects. These include also successful lobbying to influence social impact policy and legislation, the establishment of social enterprise incubation and acceleration programmes and the organisation of high-impact events and conferences that have brought global attention to social innovation efforts in the region.

MAIN FEATURES

After developing a first strategic plan in 2020, the cluster 2021 launched a "Torino Impact City 2022-2024 – Master Plan" to create a regional and international social impact ecosystem.

The strategy is based on the idea that the city's historical vocation for social entrepreneurship, the density of technological capabilities and the presence of large financial investors focused on social impact are the foundation for the social and industrial development of the metropolitan region.

In terms of content, the cluster's projects act as vehicles for the implementation of the master plan.

However, the following main features can be mapped as central functions of the cluster.

- Collaborative ecosystem: Torino Social Impact serves as a hub for fostering collaboration between different sectors. It provides a platform where individuals and organisations can share ideas, resources and best practices, encouraging cross-sector partnerships.

- Innovation and research: One of its key features is its commitment to promoting innovation and research in the social impact sector. By conducting and supporting research, they aim to find creative solutions to social problems.

- Incubation and acceleration: Torino Social Impact offers support to social enterprises and start-ups through incubation and acceleration programmes. This helps budding entrepreneurs turn their socially responsible ideas into thriving businesses.

- Advocacy and Policy Influence: The organisation actively engages in advocacy and policy discussions to shape policies that promote social impact and sustainability. They work with government bodies to ensure that the legal and regulatory environment is conducive to social initiatives.

- Sharing knowledge: Knowledge sharing is a crucial aspect of Torino Social Impact. They organise events, conferences and workshops to share insights, best practices and the latest trends in the field of social impact.

SERVICE PORTFOLIO

Torino Social Impact's service portfolio covers a wide range of activities:

- Capacity Building: TSI offers training programmes, workshops and mentorship to equip social entrepreneurs and organisations with the skills and knowledge needed to create lasting change. An example is the university course on social impact evaluation. The course is addressed to individuals who hold managerial roles within organisations of the Third Sector and social enterprises and those who are responsible for reporting the effectiveness and efficiency of activities in terms of both economic and financial and social.

- Networking opportunities: The basic idea of an open platform makes it much easier for members to establish contacts with potential partners and enables them to find potential collaborators, investors or supporters for their social initiatives.

- Impact measurement: Torino Social Impact helps organisations to effectively measure and communicate their social impact. They provide tools and resources to evaluate the results of social projects and initiatives.

- Resource mobilisation: Through access to funding opportunities and partnerships, the cluster helps its members to secure financial resources for social projects, which is crucial for sustainability and growth. A suitable example can be found in the project "Social Impact Stock Exchange". The conceptual idea about this project revolves around the creation of a capital market for social economy enterprises as a tool to promote change in the current relationship between private institutions and the public sector. It is intended to facilitate the growth and development of the social economy, while at the same time obliging financial actors to pursue objectives that go beyond the mere generation of profit.

- Awareness campaigns: The dynamism of the Torino Social Impact ecosystem has made the city a reference point for international events dedicated to impact, bringing to Turin the most important European and global networks and institutions dedicated to the social economy and impact investment. In the recent past, numerous high-level and international conferences have been organised, such as "The Global Social Business Summit 2022", the "Cities Forum 2023" together with the EU Commission DG Regio or the Annual Assembly of the European Network for Social Integration Enterprises.

Further reading:

IMPACT

Even though the cluster was only established in 2017, it is already evident after such a short time that the perception of social economy in the region has changed. Torino Social Impact provides an open platform for each member to contribute with their projects and concerns. This allows them to directly contribute to the improvement of the social economy and an increase in innovation in the region and in Italy. Because Torino Social Impact is an open platform with no legal form, its associated impacts in and through EU projects are achieved through its members, which are project partners.

One of the primary impacts of the cluster has been its role in fostering economic growth. Through support for social enterprises and start-ups, it has facilitated the creation of new businesses, employment opportunities, and the attraction of investment both in the region and through EU-funded projects.

This is what happened, among other things, in the “Social Impact Stock Exchange” which, initiated by Torino Social Impact, aims to create a capital market for companies that consciously, additionally and measurably generate positive social impacts. Within the framework of the Mock IPO, eight social institutions were selected and the IPO was realistically simulated. This included the selection of the financial market, the listing process, the development of an impact strategy and the creation of a checklist of the sustainability profile of the companies. All companies were supported in the simulation by so-called cross-functional technical working groups that consisted of the following experts: Financial advisors, auditing firms, legal advisors, financial communication advisors and investor relations advisors.

The simulated stock market listing of the first companies showed that even companies in the social economy, which are often accused of not being "marketable", manage to go public both structurally and in terms of their dimensions with measurable economic and social values. And it has paid off. Because more than 150 companies have already expressed their interest in collaborating.

However, Torino Social Impact does not only influence the financial performance and cooperation of companies. The impact of the work can be seen on a political as well as on a societal level. For example, the EU project RESPONDET aims to improve the capacity of local and regional policy makers, public administration, social economy and civil society to jointly develop (policy) initiatives that would strengthen the social economy-oriented management of resources by the community. In addition to four seminars bringing together local and regional authorities, social economy, civil society and other stakeholders, action plans were developed as an outcome in the four cooperating cities/regions: Catalonia, Wallonia, Turin and Malopolska Region.

At the social level, the direct effects of Torino Social Impact cluster on the region can be seen in a course on social impact assessment, which is run by the Faculty of Management at the University of Turin. The course aims to improve knowledge and skills in the field of impact assessment and is aimed at people in management positions in third sector organisations and social enterprises. It includes a total of 125 hours of lectures, practical training and project work. To date, four courses have been completed. More than 300 people have participated and obtained the Social Impact Assessor certificate. Social action is thus becoming part of the continuing human resource development of companies in the region.

All in all, Torino Social Impact cluster has contributed significantly to enhance access to capital for socially responsible ventures. The cluster has made substantial contributions to the region and the City of Turin by addressing social, economic, and environmental challenges. While it has achieved numerous positive impacts, continued support, innovation, and collaboration will be essential to further its mission of creating a more inclusive and sustainable community.

LESSONS LEARNED AND TRANSFERABILITY

Clusters offer fundamental advantages for regional innovation systems that other actors do not. They repeatedly play the role of intermediaries by bringing together enterprises (especially SMEs) and research and innovation actors and thereby enable enterprises to increase their innovation capacity. In addition, their technical depth makes it easy to bring the needs of a region's enterprises closer to policy makers. In turn, their political proximity gives them the advantage of influencing regional innovation policy. As a rule, however, clusters are always in indirect competition with each other for attention, members and financial resources. The Piedmont region has created a cluster system that does not see cluster organisations as competitors, but rather uses the thematic strengths of the various actors to promote the region equally in all areas. Be it in dealing with start-ups, planning events or coordinating themes. In this way, the clusters work together as a cohesive community for the region.

Paradoxically, the example of Torino Social Impact shows that a cluster does not have to be involved in the political decision-making system of the region in order to bring benefits to the region and the sector and to strengthen their innovative capacity. The strong involvement of the platform at European level also generates added value for the whole region.

RECOMMENDATIONS

Shortly after its launch, the Torino Social Impact cluster is already demonstrating that issues such as proximity and social environment are central not only to the quality of life in a region, but also to business cooperation. With its members, the cluster is already strongly represented at European level and can also strengthen the region and its social actors through its experiences and projects. However, two aspects stand out: firstly, the cluster itself rarely appears in innovation projects, even if this is its intention. Secondly, it is noticeable that the issue of the social economy (as such) has so far primarily received attention at the European level. At national and regional level, it is considered but not promoted independently. This is where the region can give it a higher priority.